IRS denies tax exemption to Texas religious group because prayer supports the Republican party

07/06/2021 / By Franz Walker

An Internal Revenue Service (IRS) official denied tax-exempt status to a Texas religious group that encouraged church members to pray for state and national leaders, because it apparently benefited the private interests of the Republican Party.

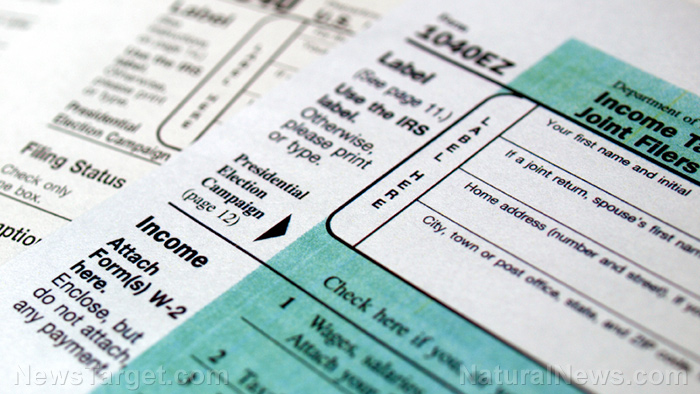

In a May 18 letter to the group, Stephen A. Martin, director of the IRS Office of Exempt Organizations Rulings and Agreements, said that Christians Engaged, a Garland, Texas-based prayer group, did not qualify as a tax-exempt organization as described in IRS Section 501(c)(3). This was despite the group being recognized by Texas officials as being tax-exempt.

“You are also not operated exclusively for one or more exempt purposes within the meaning of Section 501 (c)(3), because you operate for a substantial non-exempt private purpose and for the private interests of the D party,” he wrote. The “D party” being a reference to the Republican party, according to a novel “legend” that Martin included with his letter to the Texas religious group.

The letter was made public on Wednesday, June 16, by the First Liberty Institute. The Plano, Texas-based public-interest law firm, which specializes in religious freedom litigation, is appealing Martin’s decision on behalf of Christians Engaged.

Following the Bible is supporting Republicans

In his letter, Martin stated that the group’s activities are meant to teach members on “national issues that are central to their belief in the Bible as the inerrant Word of God.”

He specifically pointed out that the group educated Christians on what the Bible may say in regards to certain public policy issues. These include ” sanctity of life, the definition of marriage, biblical justice, freedom of speech, defense, and borders and immigration, U.S. and Israel relations.”

“The Bible teachings are typically affiliated with the [Republican] party and candidates,” Martin wrote. “This disqualifies you from exemption under IRS Section 501(c)(3).”

But Christians Engaged President Bunni Pounds, in a statement issued by the First Liberty Institute, disputed what Martin wrote in his letter.

“The IRS states in an official letter that Biblical values are exclusively Republican,” said First Liberty Institute counsel Lea Patterson in the statement. “That might be news to President Joe Biden, who is often described as basing his political ideology on his religious beliefs.”

“Only a politicized IRS could see Americans who pray for their nation, vote in every election, and work to engage others in the political process as a threat,” she added. “The IRS violated its own regulations in denying tax-exempt status because Christians Engaged teaches biblical values.”

In the appeal letter, First Liberty pointed out that Martin erred in three ways by finding that Christians Engaged did not meet the operational test.

First, it stated that Martin invented “a nonexistent requirement that exempt organizations be neutral on public policy issues.” Second, it stated that Martin “incorrectly” concluded that the group primarily served private, nonexempt purposes because he thought its beliefs overlap with Republican Party policy positions. Finally, it pointed out that Martin violated the First Amendment’s Free Speech, Free Exercise and Establishment clauses ” by engaging in both viewpoint discrimination and religious discrimination.” (Related: IRS also targeted Jewish groups)

IRS has singled out conservative and religious groups before

Martin’s letter mirrors moves made by the IRS during the administration of former President Barack Obama. Back then, the tax agency singled out hundreds of conservative, Tea Party and evangelical tax-exemption applicants for special treatment. This included long delays and multiple requests for detailed information about the activities and beliefs of officials associated with these groups.

During this time, multiple lawsuits were filed against the IRS by these groups. The Department of Justice (DOJ) eventually agreed in two separate settlements to compensate the groups for undisclosed amounts.

In addition, the DOJ has also acknowledged that the IRS targeted the groups for “heightened scrutiny and inordinate delays” on the basis of their religious and political beliefs and activities.

“There is no excuse for this conduct,” said then-Attorney General Jeff Sessions in a statement in 2017. “Hundreds of organizations were affected by these actions, and they deserve an apology from the I.R.S. We hope that today’s settlement makes clear that this abuse of power will not be tolerated.”

With this in mind, Martin’s decision is sure to ignite protests from Republicans, conservative and religious freedom advocacy groups, and civil liberties defenders.

“The act of praying for our country and our leaders is about the most nonpartisan and patriotic thing that Americans can do. Millions of citizens do it every day,” Rep. Ted Budd (R-N.C.) said in an interview with The Epoch Times.

“The IRS was wrong to deny tax-exempt status based on the false belief that the Bible somehow only belongs to one political party,” he added. “The IRS still has a long way to go to ensure religious liberty for all.”

Follow FirstAmendment.news for more on how liberals in government are working to limit freedom of speech.

Sources include:

FirstLiberty.org[PDF]

Tagged Under: Bible, big government, deception, fascism, First Amendment, freedom of speech, identity politics, IRS, lies, religious liberty, tax, tax-exempt, Texas, Tyranny

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 FIRSTAMENDMENT.NEWS

All content posted on this site is protected under Free Speech. FirstAmendment.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. FirstAmendment.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.